The 2017 Deloitte Art and Finance report “aims to act as a barometer for the emerging art and finance industry and highlights the main trends and developments in the art market.” We’ve gathered key takeaways of what you should know when it comes to trends at the intersection of art and investment.

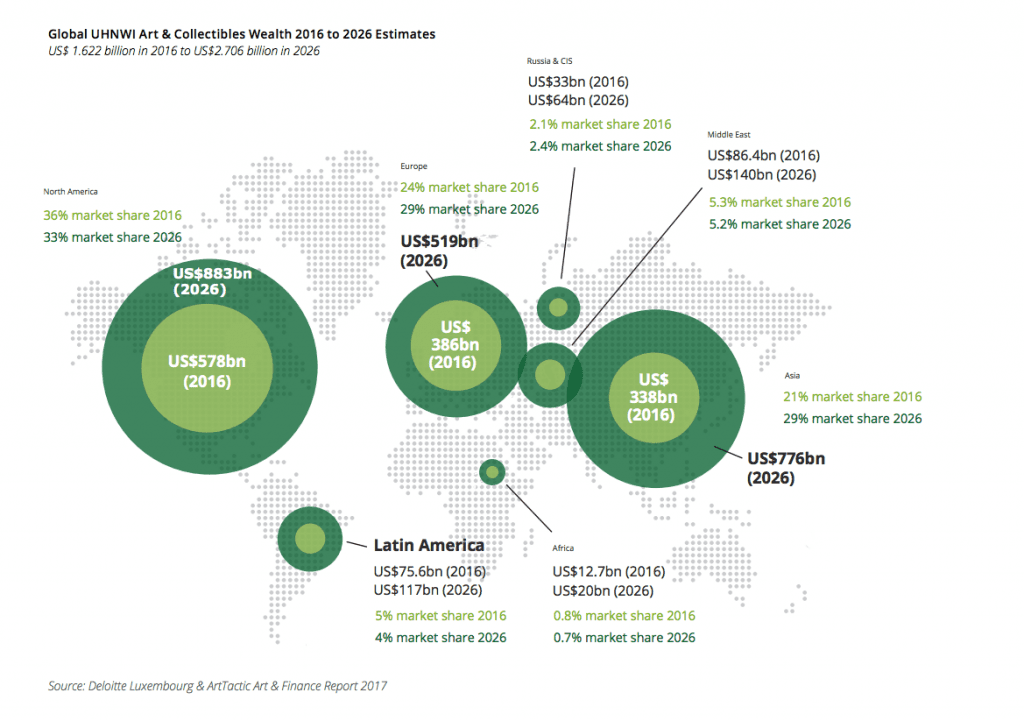

1. Art and wealth management is a part of a longer term trend. When the first Art and Finance report was authored by Deloitte six years ago, one-third of wealth managers said they were aware of art as an asset class. This year, 60% said the same, and 65% actively offer services related to art and collectibles. Why? Art market growth and higher valuation means more demand, and more wealth is being allocated to art as part of a holistic investment and wealth management strategy.

2. The art market’s renowned opacity is the biggest hurdle, and investors are calling for modernization of standards and business practices. The majority feel that more government regulation and guidelines will counter price manipulation, authenticity questions, insider trading, and anti-competitive behavior. Alumna Laura Patten’s thesis, Painting Red Flags: A Typology of Art Fraud and Risk Indicators, is cited that 87% of art authenticity frauds investigated by the FBI in the last 3 decades were perpetuated by art world insiders.

3. Auction sales are up. Sales at Sotheby’s, Christie’s, and Philips were up 18% in the first half of 2017, demonstrating healthy activity around the buying and selling of art from private collections.

4. Political and economic uncertainty is the biggest risk to the art market in the next 12 months, per a 2017 ArtTactic survey.

5. Experts are feeling more optimistic about the contemporary art market, compared to sentiments in January 2016. 62% believe the US contemporary art market will go up in the next 12 months (versus 47% in January 2016). 36% believe that the European contemporary art market will rise (an increase from 14%). 32% believe the Chinese contemporary art market will go up (up from 26%).

6. Wealth management advisors are increasingly converging with art advisors and collection managers. 78% of wealth managers say they now offer art collection services.

7. Technology, data, and analytics are playing a major role in making the art market and investment decisions transparent. Online sales of art are growing - $3.75 billion in 2016, which was an 8.5% share of the overall market (up 15% from the year before). Blockchain could be a game changer for the valuation and authenticity of art.

8. Social media is influencing the creation of art, as well as shifting the low- and middle-end market by allowing artists to showcase and market their work directly to buyers. SIA alum Josh Campbell, co-founder of the marketing and art-recognition platform Canvas Collective, is quoted: “middle market transactions might not have headliner prices, but the sheer scale and quality of this market is starting to have a lot of appeal for sellers.”